Contents

Bezpłatne zarządzanie portfelem, niskie ceny, doskonała platforma handlowa i najwyższej klasy usługi. Pochodzenie nazwy rubel nie jest do końca jasne, część ekspertów wskazuje jednak na ruskie słowo rubit, czyli odcinać. W domyśle chodzi o odcinanie od sztuki srebra. Wcześniej zostało już wspomniane o tym, jak dzielił się rubel i kto wprowadził taki system monetarny.

Można się nim posługiwać również w republikach Abchazji i Osetii Południowej. Na Białorusi i Naddniestrzu także w użyciu jest rubel w odpowiedniej odmianie - rubel białoruski i naddniestrzański. Podobna sytuacja przedstawia się w kantorach stacjonarnych, zwłaszcza tych umieszczonych na lotniskach, dworcach czy centrach handlowych.

Jednak niewielu z nas wie, skąd w ogóle pochodzi do określenie. Wynika to z faktu, że na terenie zachodniej Rosji w średniowieczu, dostępne były srebrne sztabki, zwane “grzywnami”. Niekiedy posiadały one cztery linie, dzięki którym mogły być one podzielone na cztery srebrne ruble. Rosja dla wielu osób pozostaje wciąż specyficznym krajem.

W późniejszych wiekach jej znaczenie zmieniało się, ale nazwa funkcjonowała już niezmiennie. Oczywiście obecny kształt tego, czym jest rubel rosyjski, nie ma już większego związku z historią, gdy stanowił odzwierciedlenie w drogich kruszcach. W tym momencie wszystkim, co związane z walutą, zajmuje się Rosyjski Bank Centralny. Buklemiszew od razu podkreśla, że obecny kurs rubla powstaje w zupełnie inny sposób, bo ani podaży, ani popytu na walutę w Rosji nie można rozpatrywać w kategoriach wolnego rynku. Całość podaży waluty, która jest na rynku konfrontowana jest z popytem na tę walutę.

Forbes Polska

Mechanizm płatności, na jaki przymyka oko Komisja Europejska, polega na prowadzeniu przez importerów rosyjskich surowców specjalnego rublowego rachunku w rosyjskim banku w rublach. Teoretycznie sama płatność jest przekazywana w euro, ale od razu następuje jej przeliczenie na ruble. Co w praktyce sprowadza się do równoległego zakupu rubli za euro przez importera.

Spadek aktywności importerów powoduje niższy popyt na waluty obce i umacnia rubla. W środę kurs rubla był najmocniejszy do dolara od czerwca 2015 r., a do euro od listopada 2014 r. Śledź kurs rubla rosyjskiego na wykresie i obserwuj trendy. Dolaryzacji kraju, co mogłoby spowodować załamanie rubla, banki komercyjne dostały zakaz otwierania nowych lokat w walutach obcych.

Kurs rubla. Rosyjskie media: „najlepsza waluta świata”

W 1704 roku, w wyniku reformy pieniężnej , Piotr Wielki ostatecznie ukonstytuował rubla jako rosyjską walutę. Kursy walut przedstawione na stronie nie stanowią oferty w rozumieniu prawa i stanowią wyłącznie informację dla klientów. W przypadku braku waluty w kantorze, zostanie ona zamówiona.

.jpeg)

Mimo łagodzenia ograniczeń na rynku walutowym doszło do silnego ruchu spadkowego, który sprawił, że rosyjska waluta umocniła się o niemalże 60 proc. Ponadto aprecjacja rubla następowała, kiedy rosyjski bank centralny przystąpił do obniżenia głównej stopy procentowej - w kwietniu i maju 2022 r. CBR trzykrotnie obniżył stopy procentowe łącznie Decyzje finansowe korporacje, Finanse korporacyjne o 900 b.p. Tym samym decyzja ta powstrzymała serię spadków kursu USD/RUB. Po pierwsze, już na samym początku wojny Bank Rosji wprowadził ograniczenia w wypłacaniu dewiz z depozytów walutowych. Zgodnie z postanowieniem rosyjskiego banku centralnego klienci rosyjskich banków komercyjnych mogą wypłacić ze swoich lokat walutowych do 10 tys.

Czy świat czeka kolejny konflikt zbrojny? To byłaby katastrofa także dla Europy

Po części w wyniku spadku importu, ale eksport też tu gra olbrzymią rolę. Istotną rolę gra też kontrola odpływu kapitału przez Bank Rosji, choć na początku czerwca poluzowana. Czołowi urzędnicy w rządzie i banku centralnym przedstawili w poniedziałek przeciwne poglądy na temat docelowego kursu rubla. Pierwszy wicepremier Andriej Biełousow Łączność powiedział, że władze dyskutowały o wyznaczonym celu dla rubla i nadawaniu priorytetu wzrostowi gospodarczemu. Powiedział, że "optymalny" poziom wynosi od 70 do 80 rubli za dolara. Kilka godzin po pojawieniu się komentarzy Biełousowa, wysoki rangą bankier centralny ostrzegł przed taką zmianą polityki — podaje Bloomberg.

Kurs rubla, jak można było się spodziewać, zaczął szybko spadać, ale już po kilku tygodniach stała się rzecz nie tyle dziwna, bo wytłumaczalna, ale jednak dziwaczna. Rubel zaczął się umacniać i do tej pory pozostaje droższy niż przed wojną. W maju Bloomberg odnotował, że rubel stał się najszybciej drożejącą walutą świata, bo od początku roku zyskał już 11 proc. Mijały kolejne tygodnie i rubel się nie osłabiał. Rosyjskie media propagandowe chętnie podłapały stwierdzenie, że rubel to „najlepsza waluta świata”. Nałożenie na Rosję sankcji spowodowało ucieczkę zagranicznych inwestorów z rosyjskich rynków i spadek płynności, co przekłada się na wyższą zmienność kursu.

Jeśli chcesz zobaczyć wykres w danym przedziale czasowym, przejdź do strony – kursy walut wykresy. Polska waluta jest coraz mocniejsza, mając wsparcie w wyraźnie osłabiającym się dolarze. We wrześniu średnia cena nowego samochodu osobowego wzrosła rok do roku o 17,2 proc., do 160,2 tys. Ale faktyczne wydatki mogą okazać się dużo większe, bo wysoka inflacja mocno podniosła koszt finansowania auta kredytem lub leasingiem. Doraźna kontrola rynku kapitałowego pomogła rublowi, ale wielkość obrotów w Moskwie zmalała w porównaniu z sytuacją sprzed inwazji.

- Eksporterzy są zobowiązani do natychmiastowej sprzedaży 80 proc.

- Podobnie jak przedstawiciele wielu innych państw.

- Nasza gospodarka okazała się odporna na zachodnie sankcje, rubel wyraźnie umacnia się — stwierdził w piątek prezenter w telewizji.

- Potwierdzają to też prognozy CBR - nadwyżka na poziomie 145 mld dol.

W odpowiedzi na sankcje Zachodu władze nałożyły kontrolę kapitału. Im bardziej rozrastało się Imperium Rosyjskie, tym bardziej zwiększał się zasięg rubla rosyjskiego, który stawał się coraz Jak wejść na giełdzie dla kobiet bardziej pożądanym środkiem płatniczym. My również, kiedy kontrolę nad naszym ludem przejął car rosyjski, używaliśmy tej waluty. Rubel wytwarzany był od samego początku ze srebra.

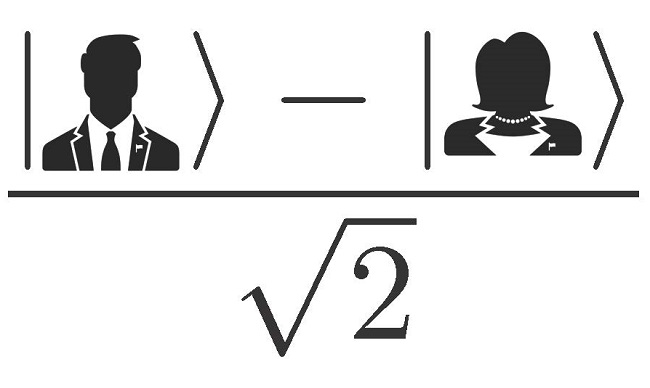

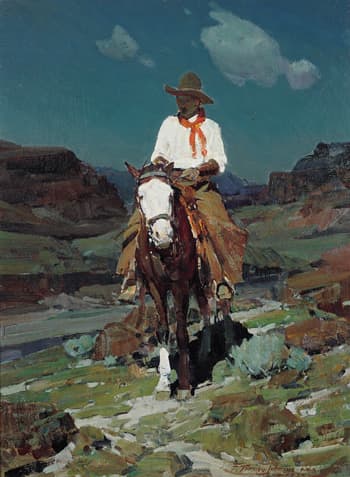

Waluta ta dzieli się na podjednostki zwane kopiejkami. Skąd wzięła się dla nich tak charakterystyczna nazwa? Ponieważ na monetach tych wybijany był jeździec z kopią, inaczej kopiejką. Jeden rubel to 100 kopiejek i taki podział był wprowadzony w Rosji już w 1704 roku za panowania Piotra Wielkiego.

Gdzie zapłacimy rublami?

Po czwartkowym osłabieniu dolara (związanym z protokołem z posiedzenia Fedu) w piątek przyszło lekkie jego umocnienie. Końcówka listopada nie szykuje się zbyt dobrze dla globalnych rynków finansowych. To skutek odcinania przez Rosję największych gospodarek Unii od dostaw.

Skąd się wzięła nazwa złoty?

'Złoty' pochodzi oczywiście od złota, a dokładnie od złotych pieniędzy. Początkowo termin ten dotyczył jednak nie konkretnej monety, a określonej wartości w złocie. W czasach I Rzeczpospolitej jeden złoty dzielił się na 30 groszy. A skąd wzięła się nazwa grosz?

Co więcej, 7 czerwca Bank Rosji zwiększył z 50 do 150 tys. Miesięcznie limit dla rezydentów rosyjskich i obcokrajowców z krajów "zaprzyjaźnionych" przelewu na konto zagraniczne lub innej osobie. Z tym umacnianiem rubla to Putin przesadził. Rubel rosyjski w standardzie ISO 4217 oznaczony jest kodem RUB. Mniej charakterystyczny w naszych oczach jest symbol rubla używany na terenie Federacji Rosyjskiej i zapisany cyrylicą - „pyϭ”. Co ciekawe, w 2013 roku dla rosyjskiej waluty ustalono nowe oznaczenie graficzne - „₽”.

Jednak w późniejszym czasie zaczęły powstawać monety o wyższej wartości wykonane ze złota lub platyny. Większość z nas kojarzy rubla rosyjskiego w międzynarodowym formacie, oznaczonego jako RUB. Wynika to z faktu, że oznaczenie to najczęściej spotykane jest na tablicach walutowych. Mniej znane dla nas jest oznaczenie pisane cyrylicą “py6”, abo symbolem „₽”.

W poniedziałkowe popołudnie za dolara płacono na rynku 57,7 rubla. Rubel jest najmocniejszy względem amerykańskiej waluty od marca 2018 roku. Choć cena waluty Rosji się ustabilizowała, sytuacja w tym kraju wciąż jest niejasna. Szczególnie trudna dla osób przyjeżdżających z zachodu. Na pewno dobrze mieć ze sobą gotówkę, ale zdecydowanie lepiej euro i dolary, które będzie można wymienić na miejscu po lepszym kursie, niż ten w Polsce. Bankomaty są ogólnodostępne nawet w mniejszych miejscowościach, ale korzystanie z nich może być obciążone dodatkowymi kosztami.

Dodatkowym atutem dla Rosji są wysokie ceny sprzedawanych surowców. Wpływy rosyjskiego budżetu, w porównaniu z poprzednim rokiem, podwoiły się dzięki sprzedaży gazu i ropy. Silny rubel może teoretycznie pomóc w zahamowaniu inflacji, która w tym roku może dojść do 24 proc., do poziomu najwyższego od 1999 r. Ceny jednak szybko rosną, bo import jest zakłócony i brakuje zagranicznych komponentów. Paweł Biriukow, ekonomista z Gazprombanku przewiduje, że w połowie roku inflacja dojdzie do 27 proc.

Co było przed zł?

Złoty wprowadzony został do obiegu 29 kwietnia 1924 roku w wyniku reformy pieniężnej przeprowadzonej przez ministra finansów Władysława Grabskiego i zastąpił zdewaluowaną markę polską, walutę Królestwa Polskiego (regencyjnego). Nowa waluta została oparta na parytecie złota, wartość 1 złotego ustalono na 9/31 grama (ok.

Z ostatnich danych Banku Rozrachunków Międzynarodowych wynika, że rosyjski rubel odpowiada za 1,1 proc. Światowego handlu walutami, co jest wynikiem wyższym niż w wypadku złotego (0,7 proc.). Rosja jest też siódmym pod względem udziału importerem polskich produktów, kurs RUB/PLN jest więc również istotny dla niektórych polskich przedsiębiorców.

Te jednak wzrosły ostatnio skokowo, jeśli chodzi o gaz, a na ten w Unii embarga nawet się nie planuje. Jego cena w kontraktach lipcowych przekroczyła w czwartek aż 130 euro za megawatogodzinę, podczas gdy jeszcze 13 czerwca była na poziomie 83 euro. Według analityków cytowanych przez agencję władzom brakuje środków, by wpłynąć na rosyjską walutę, nawet gdyby tego chciały.