A precious metals futures contract is a legally binding agreement for delivery of a metal in the future at an agreed-upon price. The contracts are standardized by a futures exchange as to quantity, quality, time and place of delivery. Since ancient Egypt, gold has been thought of as a store of wealth.

- The gold futures market is one of a number of commodity futures, wherein contracts are entered into, agreeing to buy or sell gold at a certain price at a specified future date.

- The process was carried over to the British Empire where one pound sterling was worth one troy pound of silver.

- There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

- Widget stop working sending an ugly error message that there is a constant missing and expected.

- While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar.

Gold began to decline Friday after the preliminary U.S. manufacturing and service-sector sentiment data beat expectations for March. The flash U.S. manufacturing Purchasing Managers Index advanced to 49.3, marking a five-month high. And the service sector saw the PMI reading jump to 53.8 in March, marking an 11-month high. A troy ounce is about slightly heavier than an imperial ounce by about 10%.

ARE THE GOLD PRICES PER OUNCE THE SAME AROUND THE GLOBE?

It also trades on the Hong Kong Stock Exchange, Singapore Stock Exchange and the Tokyo Stock Exchange. When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold. Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

Although these aren’t regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market. There is usually a difference between the spot price kitco 3 day gold chart of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future.

The bid price is the highest price someone is willing to pay for an ounce of gold. This is the change in the price of the metal from a year ago today, as opposed from the previous close. This is the change in the price of the metal from 30 days ago as opposed from the previous close. The biggest variable for gold going forward is the contagion risk in the banking sector.

And the central question is whether Washington is willing to backstop all depositors. Treasury Secretary Janet Yellen and Fed Chair Jerome Powell have been sending mixed signals. Also, St. Louis Fed President James Bullard said Friday that as the banking sector stress eases, the Federal Reserve will have to raise rates higher. Right now, Barrick Gold, Goldcorp, Newmont Mining, Newcrest Mining and AngloGold Ashanti are among the world largest gold mining companies by market cap.

WHAT IS THE PRICE OF THE GOLD AND SILVER RATIO?

Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®. Because there is no official closing or opening price for gold or silver, market participants rely on benchmark prices, set during different times of the day by different organizations. KEEP UP WITH THE MARKETS – Find market data on all the precious metals, base metals, mining equities, cryptocurrencies, FX and more — always one tap away. For almost 100 years, the main gold benchmark price was set by the London Gold Fix. The price was determined in a closed physical auction among bullion banks.

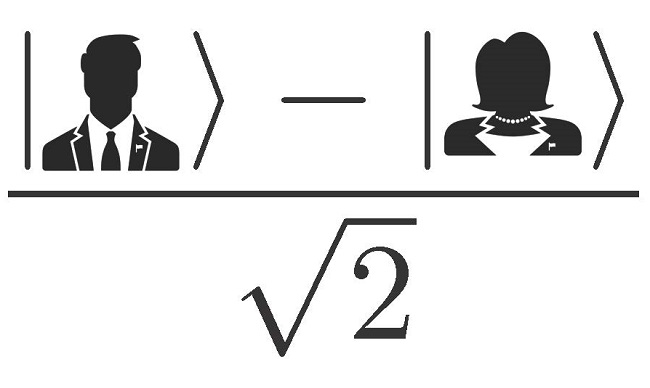

The Kitco Gold Index has one purpose that is to determine whether the value of gold is actual, a reflection of changes in the US Dollar value, or a combination of both. The banking crisis is doing the work for the Fed, and there could be a credit crunch coming, Cholly warned. The banking crisis, combined with the Fed rate hike expectations easing, is creating “true risk-off haven flows,” the technical strategist added. “The bond market is telling us we will get a rate cut. That is favorable for gold. We see a correction after a big rally. But that is not enough to change the trend,” Cholly said.

KITCO NEWS – Watch the best industry videos and stories from Kitco News, delivered right to your phone. Our editorial and development teams are working hard to roll out new features regularly. BREAKING NEWS AND ALERTS. Never miss a story – Get real-time notifications sent directly to your phone for the biggest breaking business news. Bullard remained hawkish “in reaction to the stronger economic news and also on the assumption that the financial stress abates in the weeks and months ahead.”

The ask price is the lowest price someone is willing to sell an ounce of gold. I like the app, however I wish they had more mining stocks thats outside of the USA and allowed to watch more than one stock live of anykind. The levels to watch on the way up are $2,034, the record-high weekly close, and then $2,075. That would open the door to $2,150, Boutros said, adding that gold spent very little time above $2,000 an ounce in 2020 or 2022. Of all government mints only the South African’s Krugerrand gold coin does not have a face value and its value is completely based on the global gold price. SPDR Gold Shares – widely known as GLD – is the world’s largest gold-backed exchange-traded fund.

Kitco Gold Chart: Live 24 Hour Spot Price

The gold market retreated Friday as better-than-expected U.S. data and hawkish comments from St. Louis Fed President James Bullard weighed on prices. It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement; however, historically, there have been high and low seasonal period in the gold market. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year.

In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the “forward rate”. PMBull believes the Kitco Gold Charts are a reasonable assessment of gold’s current price, but does not warrant any chart’s accuracy or timeliness. The charts on PMBull are made available for informational purposes only. Nothing on PMBull should be construed as a live quote, nor an offer to buy or sell any security or derivative in any market.

There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesn’t corrode. This Kitco Gold Chart shows spot gold prices around the world, 24 Hours per day. The spread is the price difference between the bid and the ask price. Both gold and silver are fairly liquid markets so traders can expect to see a fairly narrow spread in these markets; however, other precious metals may have wider spreads, reflecting a more illiquid marketplace.

About this app

WATCH LIST – Build you own customized Watch List to include quotes and charts of metals, cryptos, indices, currencies, and more! While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Given that the U.S. is the world’s biggest economy and one of the most stable, the dollar has become a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

WHAT MAKES GOLD A PRECIOUS METAL?

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs.

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGC’s members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more. The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold. The benchmark price is determined twice daily in an electronic auction between participating banks with the LBMA, which is administered by ICE Benchmark Administration.

Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nation’s currency and ultimately increase domestic gold demand. A troy ounce is used specifically in the weighing and pricing of precious metals and its use dates back to the Roman Empire when currencies were valued in weight. The process was carried over to the British Empire where one pound sterling was worth one troy pound of silver.

Hedgers use these contracts as a way to manage their price risk on an expected purchase or sale of the physical metal. They also provide speculators with an opportunity to participate in the markets by lodging exchange required margin. The gold futures market is one of a number of commodity futures, wherein contracts are entered into, agreeing to buy or sell gold at a certain price at a specified future date. Gold futures are used both as a way for gold producers and market makers to hedge their products against fluctuations in the market, and as a way for speculators to make money off of those same movements in the market.